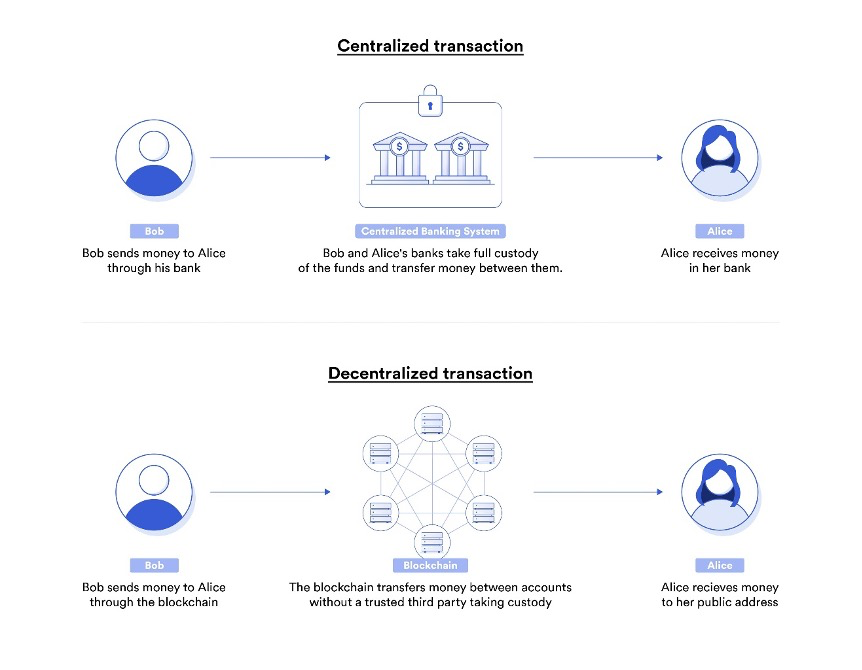

Decentralized Finance (DeFi) plays a pivotal role in revolutionizing traditional finance by democratizing financial systems through blockchain technology. DeFi eliminates centralized authority, offering a transparent and inclusive financial ecosystem12. It leverages smart contracts to automate operations like lending and borrowing, democratizing financial activities without the need for intermediaries23. Unlike traditional finance, DeFi provides transparency, global accessibility, and user control over assets, empowering individuals to engage in financial transactions without restrictions23.

The rise of DeFi platforms has the potential to transform the lives of the unbanked, offering financial inclusivity and operational efficiency3. Despite its advantages, DeFi faces challenges such as security risks and regulatory uncertainties due to its decentralized and borderless nature45. Overall, DeFi represents a paradigm shift towards a more inclusive, accessible, and autonomous financial landscape, reshaping traditional banking into a relic of the past3.

what are the benefits of defi over traditional finance

The benefits of Decentralized Finance (DeFi) over traditional finance include:

- Accessibility: DeFi is built on open-source blockchain technology, making it accessible to anyone with an internet connection, unlike traditional finance that is typically limited to those with established relationships with financial institutions12.

- Trustlessness: In DeFi, trust is placed in the code and protocols of the blockchain, enabling trustless transactions without the need for a central authority, unlike traditional finance where trust is placed in intermediaries12.

- Transparency: DeFi transactions are recorded on a public blockchain, ensuring transparency and audibility of all transactions, a feature lacking in traditional finance2.

- Immutability: Once a transaction is recorded on a blockchain in DeFi, it cannot be altered, ensuring irreversible transactions and tamper-proof records, a level of security not present in traditional finance2.

- Censorship-resistance: Decentralized systems in DeFi are more resistant to censorship as there is no central point of control, allowing transactions to occur without interference, unlike traditional finance that can be subject to censorship2.

- Interoperability: DeFi platforms can interact with each other through smart contracts, enabling the creation of new financial products and services, a level of flexibility not easily achievable in traditional finance2.

- High-yielding assets: Many DeFi protocols offer higher yields on assets compared to traditional financial institutions, attracting investors with the potential for increased returns2.

- Decentralized ownership: DeFi protocols allow for decentralized ownership, enabling anyone to participate in the network regardless of their location or financial status, promoting financial inclusivity2.

These advantages highlight how DeFi revolutionizes traditional finance by offering a more accessible, transparent, and efficient financial ecosystem.

how does defi impact the banking industry

Decentralized Finance (DeFi) significantly impacts the banking industry in several ways:

- Disintermediation: DeFi aims to eliminate intermediaries like banks by connecting borrowers directly with lenders through blockchain technology, disrupting the traditional credit check process35.

- Financial Accessibility: DeFi provides financial services in a decentralized manner, offering both banked and unbanked populations access to a public, permissionless financial network without the need for intermediaries, promoting financial inclusivity3.

- Transparency and Control: Unlike traditional banking, DeFi operates through code and smart contracts, providing open visibility and control over financial operations, enhancing trust and security for users3.

- Global Reach: Traditional financial systems are often geographically limited, while DeFi services operate universally, allowing anyone with an internet connection worldwide to access financial services without restrictions3.

- Innovation and Efficiency: DeFi drives innovation in financial services by digitizing traditional banking functions like lending, borrowing, and saving through smart contracts, making transactions faster, more efficient, and accessible to a broader audience2.

- Collaboration and Competition: DeFi platforms are increasingly collaborating with traditional banks to bridge the gap between the old and the new, offering potential for innovation and new financial products that combine the strengths of both sectors12.

- Regulatory Challenges: The rise of DeFi poses regulatory challenges for the banking industry, as it operates in a decentralized and borderless environment, potentially impacting the structure and performance of traditional financial products and services45.

- Future Evolution: DeFi’s rapid growth and increasing interconnectedness with the traditional financial system raise the potential for contagion and threats to financial stability, prompting the need for careful monitoring and policy implications to address vulnerabilities and ensure financial stability4.

Overall, DeFi’s impact on the banking industry is transformative, offering a more accessible, transparent, and efficient financial ecosystem that challenges traditional banking norms and fosters innovation in financial services.